can you go to jail for not paying taxes in florida

Tax evasion is defined as any action taken to evade the assessment of federal or state taxes. Failure to pay tax collected.

Average Jail Time For Tax Evasion Convictions Prison

Wisconsins criminal failure to file sales tax penalty is a misdemeanor.

. But failing to pay your taxes wont actually put you in jail. A judge sentences Michael to six months in jail and three years of probation for a felony drug offense. It can take many forms including not reporting income claiming expenses for work not actually performed or owed or simply not paying taxes.

Making an honest mistake on. If you are convicted of a sales tax crime then the consequences can be extremely serious. Tax evasion results in up to five years while failure to file your return will give you one year in prison for every year you do not file.

In florida tax evasion can involve income tax filings by individuals or a. You cannot go to jail for not being able to pay but you can go to jail for ignoring the court. If you dont pay the installments the Court wont order you to jail but it will give the creditor some power to pursue your assets.

The short answer is YES you can go to jail for not remitting Florida sales tax that your business collected. Willfully violate a court order. In 2016 the IRS launched nearly 3400 investigations related.

In short yes you can go to jail for failing to pay your court-ordered child support. Can you go to jail for not paying your taxes. You can however be forced to go to jail if you dont pay your taxes or child support.

Jail for Not Paying Civil Fines or Criminal Justice Debt If you dont have the money to pay court costs or fines the outcome depends on your state of residence. Lets take a closer look at the penalties for tax evasion including incarceration. In fact the IRS cannot send you to jail or file criminal charges against you for failing to pay your taxes.

If you are more than 30 days late on a child support payment your debt may be reported to a credit agency. It only takes 301 of unremitted sales tax to become a felony. Taxpayers can also go on a payment plan with the IRS to help pay off what they owe over time and depending on certain circumstances penalties and interest on taxes owed can be waived Cawley said.

The short answer is maybe. Misdemeanor if tax not paid is less 1000. Can you go to jail for not paying your taxes.

The short answer is. On October 17 1931 Judge James H. You can go to jail for lying on your tax return.

It is imperative that you protect yourself with the help of a Florida sales tax attorney immediately if you are being investigated for sales tax crimes. The first debt that you can indeed be prosecuted and put behind bars for is failure to pay taxes better known as tax evasion or in the words of the IRS tax fraud. It can take many forms including not reporting income claiming expenses for work not actually performed or owed or simply not paying taxes.

Tax obligation and that you were aware of the consequences of not paying. He is ordered to pay a base fine of 1000 and additional fees of 2000 for a total of 3000 as a condition of his probation. Can you go to jail for not filing a tax return.

Can you go to jail for not paying child support in Florida. This may have you wondering can you go to jail for not paying taxes. You can only go to jail for tax law violations if criminal charges are filed against you and you are prosecuted and sentenced in a criminal.

You may even face wage garnishment or property seizure. It is amazing how few people realize that you can go to prison for sales tax fraud. And for good reasonfailing to pay your taxes can lead to hefty fines and increased financial problems.

In Florida a judge may find that a parent with a valid enforceable child support obligation who can pay and willfully refuses to do so is in civil contempt and subject to potential incarceration. You can go to jail for not filing your taxes. Felony if tax not paid is 1000 or more.

For other less serious tax-related problems such as not paying always know that the IRS must go through a variety of steps before they take legal action. If you file your return but cant afford the tax bill you wont go to jail. Yes but only in very specific situations.

Skip to content All About Incomes Questions and Answers All About Incomes Questions and Answers. Can you go to jail for not paying taxes reddit. 500 5000 fine andor imprisonment for up to 6 months.

Supreme Court has outlawed the use of prison to punish indigent criminal defendants who fail to pay for court costs and fines as part of their sentence. Actually Florida laws on sales tax fraud are some of the toughest in the country punishable by up to 30 years in jail and 10000 in fines. Michael works for minimum wage.

But in a few situations you might face jail time in connection with a debt like if you. What Happens When You Dont Pay Your Taxes. Wilkerson sentenced Chicagogangster Al Capone to 11 years in federal prison for income tax evasion.

This can come in various forms such as a lien on your home a pay garnishment an attachment of your bank account or some other seizure of your property. 5000 25000 fine andor imprisonment for 1 3 years. Well walk you through those scenarios and help you understand the true consequences of not paying your taxes.

However you cant go to jail for not having enough money to pay your taxes. He is unable to pay the full fine and fees at the time of his sentencing. It is a federal crime for which you can receive up to five years in prison for each offense of which you are convicted.

The good news is that you will have several chances to amend the issue and make up the payments you owe. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. In fact you may be able to come up with an alternative arrangement with the IRS.

Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime.

Can The Irs Send Me To Jail For Unpaid Taxes Levy Associates Tax Help

Mase Reportedly Owes 125 000 In Back Taxes Rappers Rap Artists Rap

Go To Jail For Not Paying Florida Sales Tax

Dr Hoogerwerf Gastroenterology Specialist Saint Augustine Fl Doctor Appointment Gastroenterology Orthopedic Surgery

Zarbee S Naturals Review And Giveaway House Of Burke Nature Kids Childrens Cough Helpful Hints

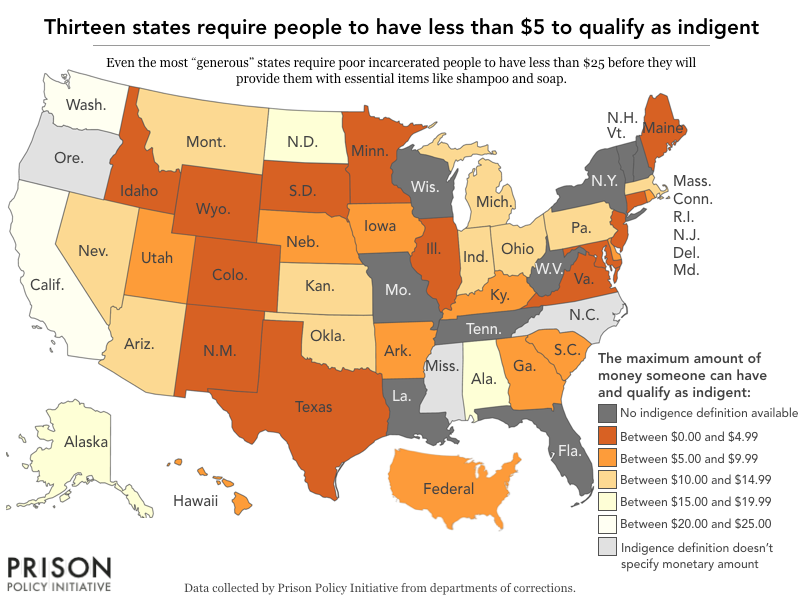

For The Poorest People In Prison It S A Struggle To Access Even Basic Necessities Prison Policy Initiative

Some People I Swear Accounting Humor Accounting Jokes Taxes Humor

5 Things You Can Go To Jail For In Florida Shane Stafford

Who Goes To Prison For Tax Evasion H R Block

Worksheet For Pre Sentence Report Fill Online Printable In Presentence Investigation Report Templ Report Template Book Report Templates Report Card Template

Go To Jail For Not Paying Florida Sales Tax

Azusa Sign Law On Baggy Pants Azusa Signs Current Events

Bail Enforcement Badges Badge Bail Enforcement Agent Police Badge

Calculate Child Support Payments Child Support Calculator Its Not Only Childr Child Support Child Support Quotes Child Support Laws Child Support Payments

People Who Are In Prison Can Get A Stimulus Check But There S A Catch What To Know Today Cnet

Putnam County Schools District Offices Reid 2nd Streets Palatka Fl 2015 Originally Atlantic National Bank 1970s Palatka Street Street View

Graph Showing How Much Minimum Wage Earners In Each State Would Pay If A Single Co Pay Took As Many Hours To Earn As A Co Pa Up Government Doctor Visit Medical

New York City Sues Fedex For Illegally Shipping Cigarettes New York City City New York